![]() Dial USSD *879# or *806#for Non –smart phone holders.

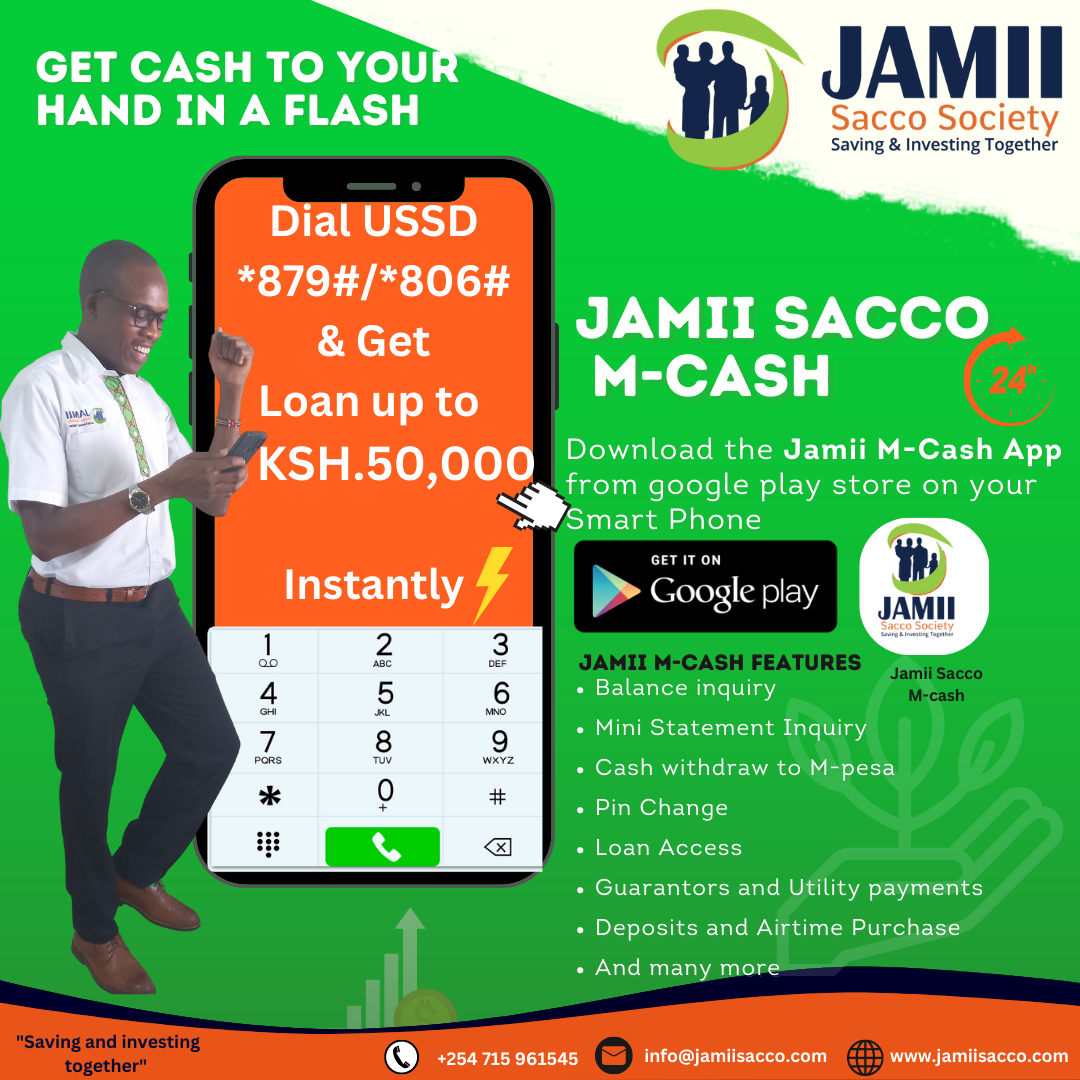

Dial USSD *879# or *806#for Non –smart phone holders.

![]() Download the Jamii M-Cash App on your Smartphone from playstore for Android phone holders.

Download the Jamii M-Cash App on your Smartphone from playstore for Android phone holders.

![]() Account balance Inquiry for all your accounts

Account balance Inquiry for all your accounts

![]() Mini statement Inquiry

Mini statement Inquiry

![]() Mobile Money/ Cash withdrawal

Mobile Money/ Cash withdrawal

![]() PIN Change

PIN Change

![]() Funds Transfer

Funds Transfer

![]() Mobile Loan Application

Mobile Loan Application

![]() Cash Deposit to all accounts

Cash Deposit to all accounts

![]() Utility Payments

Utility Payments

![]() And many more

And many more

The loan is applied and granted through mobile phone and the terms and conditions are as follows:

![]() Member must subscribe/register to the Sacco M-banking services (Fill Jamii M-Cash Form).

Member must subscribe/register to the Sacco M-banking services (Fill Jamii M-Cash Form).

![]() A member must attain the minimum share capital of Ksh. 10,000.

A member must attain the minimum share capital of Ksh. 10,000.

![]() Considers a member up to 80% of the member deposits but up to a maximum of Ksh. 50,00

Considers a member up to 80% of the member deposits but up to a maximum of Ksh. 50,00

![]() A member can qualify to borrow up to Ksh. 5,000 without graduation subject to attaining the above conditions.

A member can qualify to borrow up to Ksh. 5,000 without graduation subject to attaining the above conditions.

![]() A member eligible to borrow more than Ksh. 5,000 will be subjected to a graduation factor of 1.5 conducted once in 30 days.

A member eligible to borrow more than Ksh. 5,000 will be subjected to a graduation factor of 1.5 conducted once in 30 days.

![]() The interest rate per month will be 5.3% for I month, 6.3% for 2 months, 7.3% for 3 months, 8.3% for 4 Months and 9.3% for 5 months charged on the principal loan one off. The interest will be accrued and not recovered upfront.

The interest rate per month will be 5.3% for I month, 6.3% for 2 months, 7.3% for 3 months, 8.3% for 4 Months and 9.3% for 5 months charged on the principal loan one off. The interest will be accrued and not recovered upfront.

Repayment can either be done using either USSD (Dial *879#/*806#), Jamii M-cash App or Paybill number532200. Dial *879# or *806#, then choose in the menu the product type you want to access loan, or deposit and if using Paybill 532200 then keying the account number-ID NUMBER OR MEMBERSHIP NUMBER THEN THE PRODUCT CODE.

Some of the charges that apply for the above services are:

![]() Account Balance Inquiry – Kshs. 10.

Account Balance Inquiry – Kshs. 10.

![]() Mini Statement – Kshs. 10.

Mini Statement – Kshs. 10.

![]() Cash withdrawal – Kshs. 50 upto a maximum of Kshs. 70,000 per transaction.

Cash withdrawal – Kshs. 50 upto a maximum of Kshs. 70,000 per transaction.

NOTE:

![]() M/s Safaricom Limited Charges an average of Kshs. 5 in Airtime for every USSD Session.

M/s Safaricom Limited Charges an average of Kshs. 5 in Airtime for every USSD Session.

GENERAL LOANING CONDITIONS.

•The member must be a check off based member from public service, parastatal or stable private organization.

•The loan is granted immediately a member joins the Sacco and makes the first installment.

•A maximum loan of up to is Ksh.300,000

•1/3 of the loan granted will be transferred to the deposits and Ksh.10,000 is immediately transferred to share capital.

•The loan must be fully guaranteed by either guarantors or collateral.

•Repayment period is 20 months.

•Interest rate is 1.04% per month or 12.5 % per annum on reducing balance.

•Ability is computed based on 1/3 rule of member’s salary.

•Must be recovered through the payroll.

The following technology-based services are provided by the SACCO:-

M PESA Service.

This is a money transfer service from SACCO to members using mobile phones. The members can also make deposits and loan repayments through M-PESA Pay Bill Number 532200.

ATM Service

This is a facility that allows members to access funds from their FOSA savings accounts using Co-op Bank SACCO link card from Co-operative Bank ATM cash point or any other VISA branded ATM. The following applies:

Real Time Gross Settlement (RTGS)/ Electronic Funds transfer (EFT)

This is a service available in the SACCO for transfer of funds to members’ accounts in other banks.

Loan Clearance Facility

Members are reminded that the SACCO has a facility to clear outstanding loans except Biashara/Biashara loans and Asset Finance Loan. All loans are cleared by the SACCO including development loans, other SACCOs and bank loans as follows:

Sale of Bankers Cheques.

On behalf of Co-operative bank, the SACCO sells bankers cheques to members at a cost of Kshs 100 per leaf.

Mobile Banking Product.

The SACCO is in the process of introducing a mobile banking product where members will be able to access various services including limited credit facilities. This service will be rolled out in due course and all members will be notified accordingly.

This product finances full insurance premium for motor vehicle where members take comprehensive insurance cover with an identified insurance company namely: Co-operative Insurance Company (CIC), Madison Insurance or Direct line depending on the type of cover or any other approved insurance underwriter. The features are as follows:

This is a unit of ownership of the SACCO and members earn dividends on the same annually when declared. The Share Capital is not withdrawable but can be sold or transferred to an existing member upon one’s withdrawal from the SACCO. The minimum share capital is Kshs.20, 000.00 or 1000 shares of Kshs.20.00 each.

Reasons why a member should have a Share Capital account:

Members who have not attained this new minimum threshold should strive to do so at the earliest opportunity through the following means:

Page 1 of 2