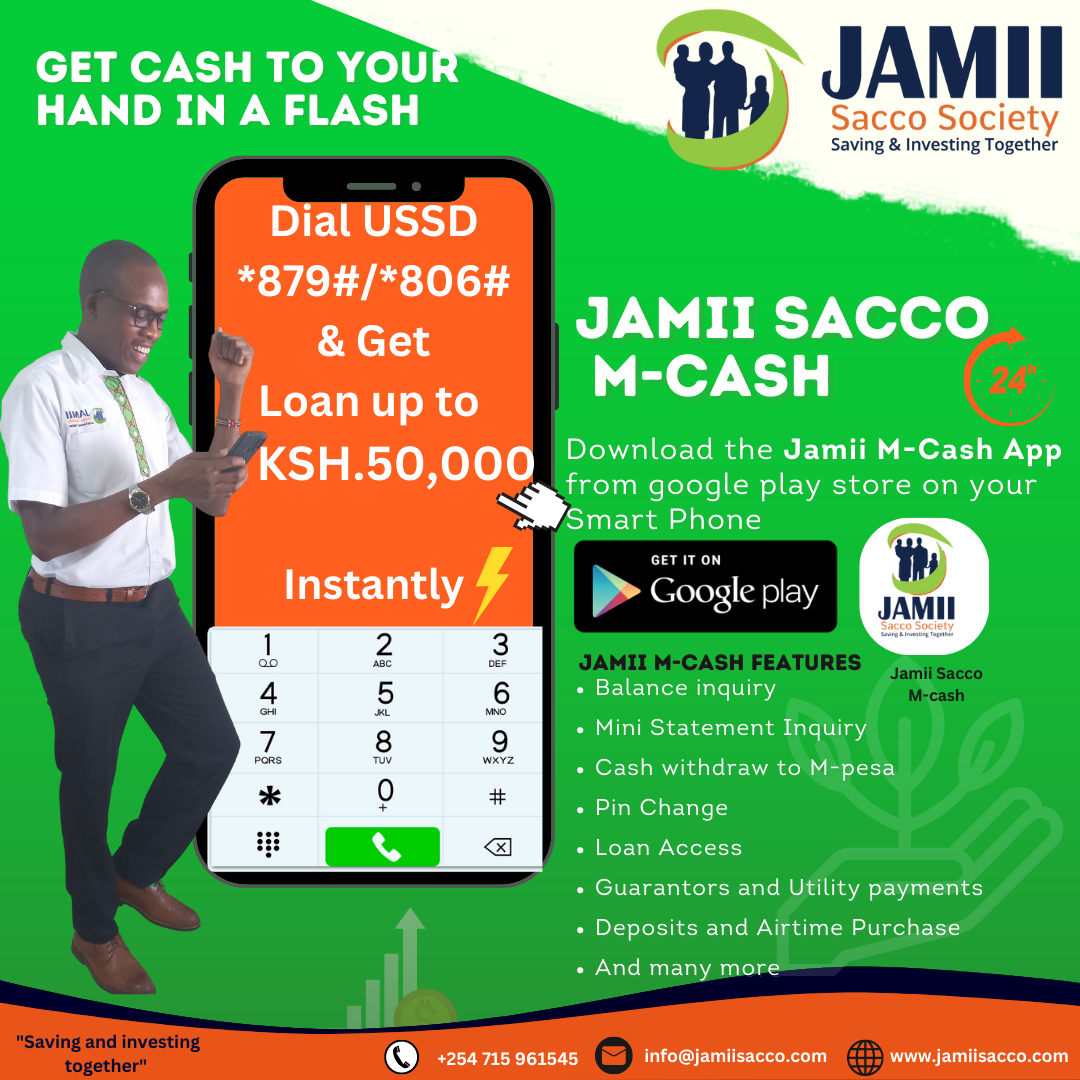

JAMII M-CASH

Access your FOSA Account; Anywhere, Anytime on your Mobile phone 24/7 on:

![]() Dial USSD *879# or *806#for Non –smart phone holders.

Dial USSD *879# or *806#for Non –smart phone holders.

![]() Download the Jamii M-Cash App on your Smartphone from playstore for Android phone holders.

Download the Jamii M-Cash App on your Smartphone from playstore for Android phone holders.

OUR JAMII M-CASH PLATFORM ALLOWS YOU TO:

![]() Account balance Inquiry for all your accounts

Account balance Inquiry for all your accounts

![]() Mini statement Inquiry

Mini statement Inquiry

![]() Mobile Money/ Cash withdrawal

Mobile Money/ Cash withdrawal

![]() PIN Change

PIN Change

![]() Funds Transfer

Funds Transfer

![]() Mobile Loan Application

Mobile Loan Application

![]() Cash Deposit to all accounts

Cash Deposit to all accounts

![]() Utility Payments

Utility Payments

![]() And many more

And many more

TERMS AND CONDITONS OF MOBILE BANKING FACILITY.

The loan is applied and granted through mobile phone and the terms and conditions are as follows:

![]() Member must subscribe/register to the Sacco M-banking services (Fill Jamii M-Cash Form).

Member must subscribe/register to the Sacco M-banking services (Fill Jamii M-Cash Form).

![]() A member must attain the minimum share capital of Ksh. 10,000.

A member must attain the minimum share capital of Ksh. 10,000.

![]() Considers a member up to 80% of the member deposits but up to a maximum of Ksh. 50,00

Considers a member up to 80% of the member deposits but up to a maximum of Ksh. 50,00

![]() A member can qualify to borrow up to Ksh. 5,000 without graduation subject to attaining the above conditions.

A member can qualify to borrow up to Ksh. 5,000 without graduation subject to attaining the above conditions.

![]() A member eligible to borrow more than Ksh. 5,000 will be subjected to a graduation factor of 1.5 conducted once in 30 days.

A member eligible to borrow more than Ksh. 5,000 will be subjected to a graduation factor of 1.5 conducted once in 30 days.

![]() The interest rate per month will be 5.3% for I month, 6.3% for 2 months, 7.3% for 3 months, 8.3% for 4 Months and 9.3% for 5 months charged on the principal loan one off. The interest will be accrued and not recovered upfront.

The interest rate per month will be 5.3% for I month, 6.3% for 2 months, 7.3% for 3 months, 8.3% for 4 Months and 9.3% for 5 months charged on the principal loan one off. The interest will be accrued and not recovered upfront.

Repayment can either be done using either USSD (Dial *879#/*806#), Jamii M-cash App or Paybill number532200. Dial *879# or *806#, then choose in the menu the product type you want to access loan, or deposit and if using Paybill 532200 then keying the account number-ID NUMBER OR MEMBERSHIP NUMBER THEN THE PRODUCT CODE.

Some of the charges that apply for the above services are:

![]() Account Balance Inquiry – Kshs. 10.

Account Balance Inquiry – Kshs. 10.

![]() Mini Statement – Kshs. 10.

Mini Statement – Kshs. 10.

![]() Cash withdrawal – Kshs. 50 upto a maximum of Kshs. 70,000 per transaction.

Cash withdrawal – Kshs. 50 upto a maximum of Kshs. 70,000 per transaction.

NOTE:

![]() M/s Safaricom Limited Charges an average of Kshs. 5 in Airtime for every USSD Session.

M/s Safaricom Limited Charges an average of Kshs. 5 in Airtime for every USSD Session.