Click on the following links to get more information on the LOAN products;

Click on the following links to get more information on the SAVINGS products;

Fosa Loans are available to members whose salaries are processed through the Jamii sawa savings account.

JAMII HOUSING CO-OPERATIVE SOCIETY LIMITED

What is Jamii Housing Society?

During the Annual General Meeting held on 20th April, 2012, the meeting deliberated and resolved to establish Jamii Housing co-operative society limited .The registration of the society has been finalised and we would like to invite interested members to register and join the Housing society.

Who can be a member of the Housing Society?

Only members of Jamii Sacco society are eligible for membership. Moving forward in the future, the Sacco will look into possibilities of opening up to the general public.

What are the requirements for joining the Jamii Housing Society?

- Must be a member of the Sacco

- Must be above 18 years of age

- Entrance fee of Kshs 2,000/= paid once.

- Attach copy of National ID card.

What are the sources of Fund for the Housing Society?

Housing Society has two sources of funds:

- Entrance fee

- Shares

For the Sacco to establish a capital base, every member will be required to contribute non –withdrawable shares of Kshs 20,000 or 200 shares of Kshs 100 each. Members should accumulate shares within six months.

What Activities and Programs will be undertaken through the Housing Society?

The members of the housing society together with the interim committee will work together to identify land to be purchased within Kenya. When land has been identified, interested members will be advised to contribute towards the purchase of the same. You may pay in cash or borrow a loan from Jamii Sacco society or any other source.

What are the benefits of joining the Housing Society?

- Easy acquisition of plots/ land through the Housing Society.

- Easy access to loans to develop the purchased plots.

- Easy processing of individual titles of ownership.

- A member may choose to sell his plot / land for a higher gain.

How do you withdraw for housing Society?

A member may withdraw from the Housing Society subject to the following conditions;

- Clearance of any Housing Society liabilities.

- Giving the Housing society 60 days notice.

At this point a member may transfer shares to an existing member or next of kin.

Interested members are invited to register and join the co-operative society to benefit from acquisition and development of property

For more information contact: Chief Executive Officer’s Office and the Marketing Office

Phone: 020- 552448/552477

Mobile No: 0704-914143/0736-613863

Jamii Housing society Limited Annual Finacial Statements For the year ended 31st December 2016.

Click on this link to Download the Statements.

Asset Finance is a facility available to all SACCO members who may desire to acquire, develop and own assets/properties. The product is available to meet purchase of various assets as follows:

A) Motorcycle, Water

Tank, Posho Mill, Solar Panel, Water Pump and Generator among others:

The terms and conditions are:

- Must be a member of the SACCO for a minimum of 3 months.

- Loan security is the Asset to be acquired.

- Loan term is a maximum of 12 months.

- Asset financed is 3.5 times of the Special savings (one must have special Savings)

- Loan amount of up to Kshs.300,000 for motorbike, tuk tuk, posh mill, solar panel, generator etc.

- Grace period is one month.

- Repayment frequency is daily, weekly, fort-nightly or monthly.

- Collateral discharge process requires member to apply for release of security from the SACCO upon clearing the loan.

- The Asset must be fully insured to the term of the loan.

B) Motor Vehicles

Terms and conditions are:

- Must be a member of the SACCO for a minimum of 3 months.

- Loan security is the Asset to be acquired.

Loan term is:

- Brand new Cars(1-7 years) – 48 months

- Used Cars up to 7 years -36 months

- Used Cars (8-10 years) -24 months.

- Loan term is maximum of 180 months for salaried members and 120 months for non-salaried members.

- The Sacco finances up to 60% of the forced value of the motor vehicle.

- Loan amount of Kshs 4,000,000 as maximum.

- Interest rate of 1.08% per month or 13 % per annum on reducing balance.

- The motor vehicle shall be jointly owned with the SACCO and comprehensively insured to term of the loan.

- Repayment and collection will be done either through check off, standing order, pay bill or cash.

- Grace period is one month.

- Repayment frequency is daily, weekly, fort-nightly or monthly.

- Collateral discharge process requires member to apply for release of security from the SACCO upon clearing the loan.

- Valuation, tracking system and legal charge to be borne by the member.

- Motor vehicle Insurance to be auto-renewed by the Sacco and members to pay the Sacco the insurance premium loan in 12 equal monthly installments at the rate of 1.08% per month or 13% per annum on reducing balance.

- Car track device to be installed by reputable service providers appointed by the Sacco and SLAs to be drawn and signed with clear terms and conditions.

- Log Books to be used as collateral to be regularly checked/ verified with NTSA and the insurers to confirm status by credit administration team.

- The Sacco will finance specific motor vehicles that have resale value.

- Matatus and tractors will not be financed by the Sacco except for the members who have accessed similar loans and with good repayment history.

C) Mortgage (Land and Property):

The terms and conditions are:

- Must be a member of the SACCO for a minimum of 3 months.

- Member to acquire it for buying commercial & residential land( within municipalities & urban areas).

- Loan term is maximum of 120 months.

- Asset financed 5 times of Special savings.

- Loan amount of up to a maximum of Kshs.10,000,000 for commercial land.

- Financing will be 100% of the purchase price plus the processing fees & other incidental costs.

- Land must have freehold title or a lease certificate with not less than 20 years before expiry.

- Maximum loan of Kshs.6,000,000 for agricultural land & limit the collateral value to forced sale value.

- Grace period is one month.

- Interest rate of 1.08 % per month or 13 % per annum on reducing balance.

- Processing fee is 2% of the cost of the Asset.

- Collateral discharge process requires member to apply for release of security from the SACCO upon clearing the loan.

- Valuation and legal charges to be borne by the member.

- Valuation and Charge to be conducted by SACCO appointed service providers.

Back Office Services Activity (BOSA) enables a member to make deposits and access credit services. The Deposit Accounts in BOSA include the following:

DEPOSITS.

These are non-withdrawable savings but are refundable on exit. The minimum contribution is Kshs 2,000 per month or 10% of basic salary whichever is higher. All members who have not attained the above minimum monthly contribution are encouraged to do so.

EDUCATION LOAN SCHEME (ELS).

This is special savings for members who may wish to access educational loans. The same is considered in multiples of 3 times subject to ability to pay.

MICRO-SAVINGS.

This is a savings account for Small and Micro–Enterprises. Members can access credit 3 times the savings depending on the product. Micro-savings accounts are as follows:

Biashara Savings/Biashara plus Savings: These are savings accounts available to all members who operate businesses. Credit is considered in multiples of 3; subject to ability to pay and acceptable security. Loan approval is based on graduated levels.

MICRO - GROUPS JOINING CONDITIONS:

- Registration Certificate from relevant government agency/department.

- Minimum number of members in a group is five (5) for investment groups and ten (10) for Micro - Credit groups.

- Original and complete copy of the Groups Constitution (Memorandum) and certified by Sub-County Social Development Officer (SCSDO).

- Each official who is a signatory should submit a current photocopy of the original identity card or current passport and one colored passport size photo.

- A letter from the Sub-County Social Development office introducing the authorized group.

- Minutes of the meeting where a resolution was passed to open an account with Jamii SACCO duly certified by Sub-County Social Development Officer. (SCSDO).

- Minutes stating the terms and conditions of borrowing and withdrawing of group funds from the SACCO.

- List of all Group members indicating their full names, identity cards numbers, personal cell phone numbers, email addresses & specimen Signatures. Payment of entrance fee of Ksh 300 per member.

- PIN certificate and Credit Reference Bureau (CRB) report for all group members.

ASSET FINANCING SAVINGS.

This is a special savings account for SACCO members who are interested to acquire assets such as land, housing, and commercial motor vehicles. Credit is considered in multiples of 3.5 and 5.

BENEFITS OF DEPOSITS:

- Ability to access loans in multiples of 3, 4, or 5 times on ones deposits.

- Attractive returns on deposits payable annually.

- Accumulated funds available for on-lending to members.

Front Office Services Activity (FOSA) offers basic banking services. The Jamii Savings Accounts in FOSA include the following:

- SAWA Account: This is a withdrawable savings account where salaries, refunds and loans processed are paid into and from where the members access them. Members make monthly savings to the same account.

- Junior Savings: This is a savings account available to junior savers (children below age 18 years old).

- Special Deposit Accounts (SDA): This account gives a member an opportunity to save and attracts high interest rates in 3 months, 6 months, 9 months or 12 months with minimum savings of Kshs.20,000/-.

- Golden Savings Accounts: Referred to as Retirement Savings. It attracts interest annually and can be pledged as collateral to loans.

- Holiday Savings Account: Open to members who would like to set aside some funds to be used during holidays or vacations of their choice.

This is a unit of ownership of the SACCO and members earn dividends on the same annually when declared. The Share Capital is not withdrawable but can be sold or transferred to an existing member upon one’s withdrawal from the SACCO. The minimum share capital is Kshs.20, 000.00 or 1000 shares of Kshs.20.00 each.

Reasons why a member should have a Share Capital account:

- To drive the SACCO business.

- To meet the SASRA requirements that is the Institutional Capital.

- It’s a long term investment with annual return.

Members who have not attained this new minimum threshold should strive to do so at the earliest opportunity through the following means:

- Mpesa PayBill.

- Standing Order.

- Cash Payment to the society.

- Check-off System

- Deduction of approved loans.

The following technology-based services are provided by the SACCO:-

M PESA Service.

This is a money transfer service from SACCO to members using mobile phones. The members can also make deposits and loan repayments through M-PESA Pay Bill Number 532200.

ATM Service

This is a facility that allows members to access funds from their FOSA savings accounts using Co-op Bank SACCO link card from Co-operative Bank ATM cash point or any other VISA branded ATM. The following applies:

- Withdrawal from CO-OP Bank ATM which currently cost Kshs.30.00 Maximum withdrawal per day is Kshs 40,000.00.

- Withdrawal from any other Visa Branded ATM cost may vary from ATM to another but is estimated on average at Kshs.200.00.

- The SACCO link card is also used to pay for goods and services in some stores eg Petrol Stations and Supermarkets e.t.c.

- With the same card members can withdraw up to Kshs300, 000.00 from any CO-OP Bank branch at a cost of Kshs 100 through Point of Sale (POS) over the counter.

- Members MUST request the office to activate the ATM card once they receive the ATM pin number.

Real Time Gross Settlement (RTGS)/ Electronic Funds transfer (EFT)

This is a service available in the SACCO for transfer of funds to members’ accounts in other banks.

Loan Clearance Facility

Members are reminded that the SACCO has a facility to clear outstanding loans except Biashara/Biashara loans and Asset Finance Loan. All loans are cleared by the SACCO including development loans, other SACCOs and bank loans as follows:

- Short term loans at 8% recoverable up-front.

- Long term loans also at 8% recoverable upfront.

- Development loans at 10% to take same type of loan.

- Clearance of other Bank and SACCOs loans is 1%.

Sale of Bankers Cheques.

On behalf of Co-operative bank, the SACCO sells bankers cheques to members at a cost of Kshs 100 per leaf.

Mobile Banking Product.

The SACCO is in the process of introducing a mobile banking product where members will be able to access various services including limited credit facilities. This service will be rolled out in due course and all members will be notified accordingly.

This product finances full insurance premium for motor vehicle where members take comprehensive insurance cover with an identified insurance company namely: Co-operative Insurance Company (CIC), Madison Insurance or Direct line depending on the type of cover or any other approved insurance underwriter. The features are as follows:

- Facility available to members of Jamii SACCO and operating a FOSA accounts.

- 12 months repayment period.

- Granted at 10% of member deposit.

- Granted based on the member’s ability to pay.

- Interest rate of 13.5% on reducing balance.

- One month grace period.

GENERAL LOANING CONDITIONS.

•The member must be a check off based member from public service, parastatal or stable private organization.

•The loan is granted immediately a member joins the Sacco and makes the first installment.

•A maximum loan of up to is Ksh.300,000

•1/3 of the loan granted will be transferred to the deposits and Ksh.10,000 is immediately transferred to share capital.

•The loan must be fully guaranteed by either guarantors or collateral.

•Repayment period is 20 months.

•Interest rate is 1.04% per month or 12.5 % per annum on reducing balance.

•Ability is computed based on 1/3 rule of member’s salary.

•Must be recovered through the payroll.

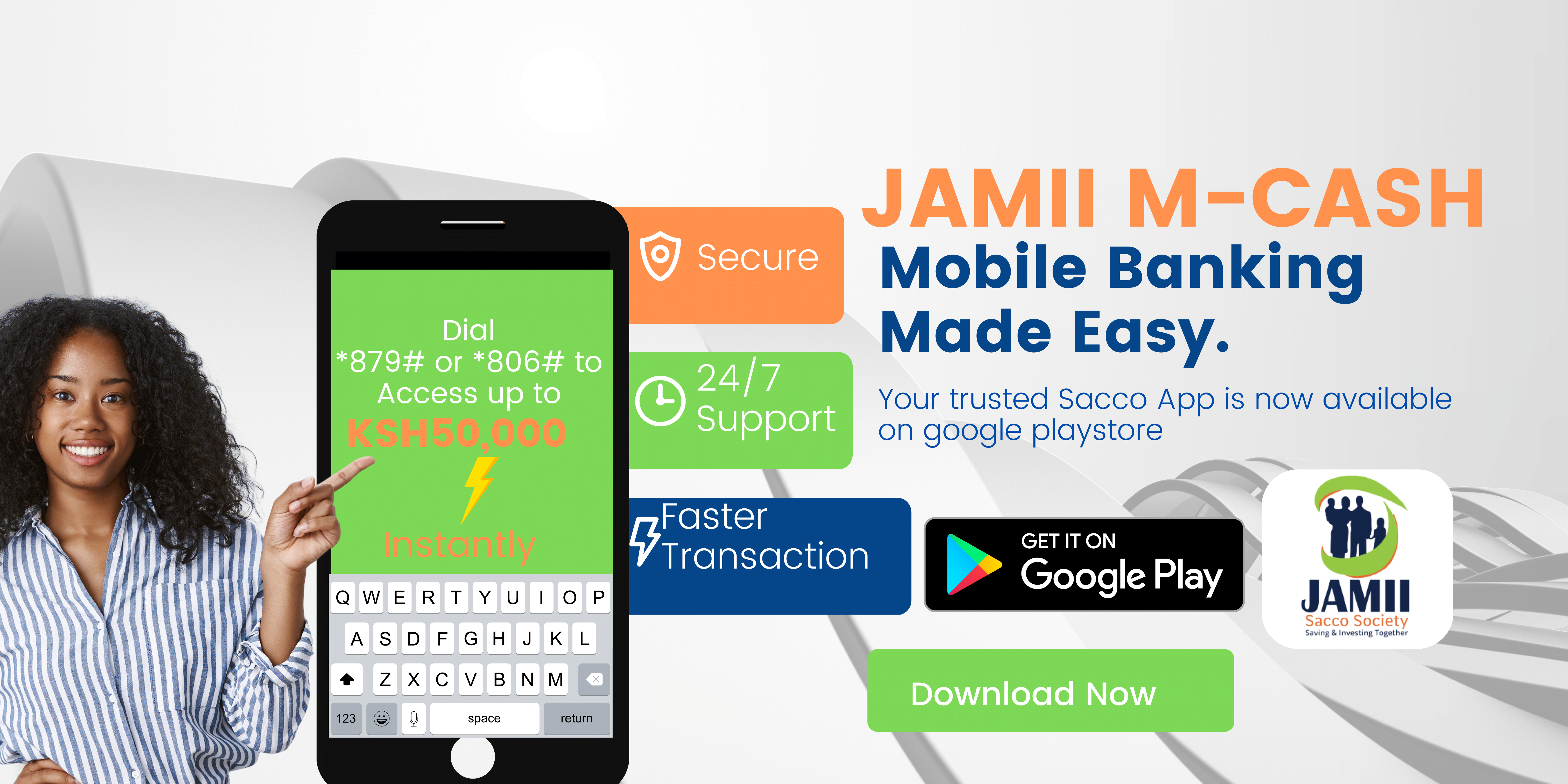

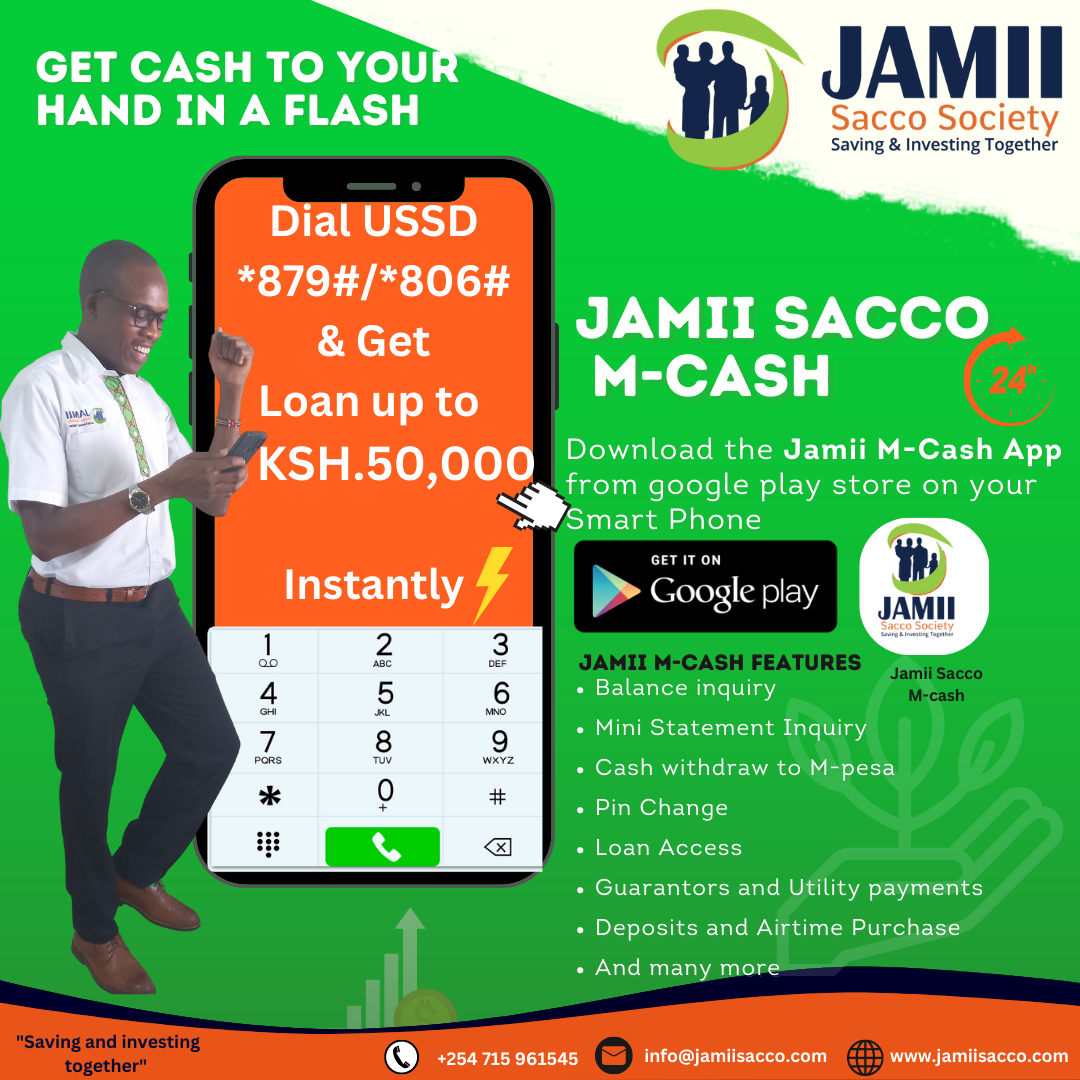

JAMII M-CASH

Access your FOSA Account; Anywhere, Anytime on your Mobile phone 24/7 on:

![]() Dial USSD *879# or *806#for Non –smart phone holders.

Dial USSD *879# or *806#for Non –smart phone holders.

![]() Download the Jamii M-Cash App on your Smartphone from playstore for Android phone holders.

Download the Jamii M-Cash App on your Smartphone from playstore for Android phone holders.

OUR JAMII M-CASH PLATFORM ALLOWS YOU TO:

![]() Account balance Inquiry for all your accounts

Account balance Inquiry for all your accounts

![]() Mini statement Inquiry

Mini statement Inquiry

![]() Mobile Money/ Cash withdrawal

Mobile Money/ Cash withdrawal

![]() PIN Change

PIN Change

![]() Funds Transfer

Funds Transfer

![]() Mobile Loan Application

Mobile Loan Application

![]() Cash Deposit to all accounts

Cash Deposit to all accounts

![]() Utility Payments

Utility Payments

![]() And many more

And many more

TERMS AND CONDITONS OF MOBILE BANKING FACILITY.

The loan is applied and granted through mobile phone and the terms and conditions are as follows:

![]() Member must subscribe/register to the Sacco M-banking services (Fill Jamii M-Cash Form).

Member must subscribe/register to the Sacco M-banking services (Fill Jamii M-Cash Form).

![]() A member must attain the minimum share capital of Ksh. 10,000.

A member must attain the minimum share capital of Ksh. 10,000.

![]() Considers a member up to 80% of the member deposits but up to a maximum of Ksh. 50,00

Considers a member up to 80% of the member deposits but up to a maximum of Ksh. 50,00

![]() A member can qualify to borrow up to Ksh. 5,000 without graduation subject to attaining the above conditions.

A member can qualify to borrow up to Ksh. 5,000 without graduation subject to attaining the above conditions.

![]() A member eligible to borrow more than Ksh. 5,000 will be subjected to a graduation factor of 1.5 conducted once in 30 days.

A member eligible to borrow more than Ksh. 5,000 will be subjected to a graduation factor of 1.5 conducted once in 30 days.

![]() The interest rate per month will be 5.3% for I month, 6.3% for 2 months, 7.3% for 3 months, 8.3% for 4 Months and 9.3% for 5 months charged on the principal loan one off. The interest will be accrued and not recovered upfront.

The interest rate per month will be 5.3% for I month, 6.3% for 2 months, 7.3% for 3 months, 8.3% for 4 Months and 9.3% for 5 months charged on the principal loan one off. The interest will be accrued and not recovered upfront.

Repayment can either be done using either USSD (Dial *879#/*806#), Jamii M-cash App or Paybill number532200. Dial *879# or *806#, then choose in the menu the product type you want to access loan, or deposit and if using Paybill 532200 then keying the account number-ID NUMBER OR MEMBERSHIP NUMBER THEN THE PRODUCT CODE.

Some of the charges that apply for the above services are:

![]() Account Balance Inquiry – Kshs. 10.

Account Balance Inquiry – Kshs. 10.

![]() Mini Statement – Kshs. 10.

Mini Statement – Kshs. 10.

![]() Cash withdrawal – Kshs. 50 upto a maximum of Kshs. 70,000 per transaction.

Cash withdrawal – Kshs. 50 upto a maximum of Kshs. 70,000 per transaction.

NOTE:

![]() M/s Safaricom Limited Charges an average of Kshs. 5 in Airtime for every USSD Session.

M/s Safaricom Limited Charges an average of Kshs. 5 in Airtime for every USSD Session.