Click on the following links to get more information on the LOAN products;

Click on the following links to get more information on the SAVINGS products;

Fosa Loans are available to members whose salaries are processed through the Jamii sawa savings account.

JAMII HOUSING CO-OPERATIVE SOCIETY LIMITED

What is Jamii Housing Society?

During the Annual General Meeting held on 20th April, 2012, the meeting deliberated and resolved to establish Jamii Housing co-operative society limited .The registration of the society has been finalised and we would like to invite interested members to register and join the Housing society.

Who can be a member of the Housing Society?

Only members of Jamii Sacco society are eligible for membership. Moving forward in the future, the Sacco will look into possibilities of opening up to the general public.

What are the requirements for joining the Jamii Housing Society?

What are the sources of Fund for the Housing Society?

Housing Society has two sources of funds:

For the Sacco to establish a capital base, every member will be required to contribute non –withdrawable shares of Kshs 20,000 or 200 shares of Kshs 100 each. Members should accumulate shares within six months.

What Activities and Programs will be undertaken through the Housing Society?

The members of the housing society together with the interim committee will work together to identify land to be purchased within Kenya. When land has been identified, interested members will be advised to contribute towards the purchase of the same. You may pay in cash or borrow a loan from Jamii Sacco society or any other source.

What are the benefits of joining the Housing Society?

How do you withdraw for housing Society?

A member may withdraw from the Housing Society subject to the following conditions;

At this point a member may transfer shares to an existing member or next of kin.

Interested members are invited to register and join the co-operative society to benefit from acquisition and development of property

For more information contact: Chief Executive Officer’s Office and the Marketing Office

Phone: 020- 552448/552477

Mobile No: 0704-914143/0736-613863

Jamii Housing society Limited Annual Finacial Statements For the year ended 31st December 2016.

Click on this link to Download the Statements.

Asset Finance is a facility available to all SACCO members who may desire to acquire, develop and own assets/properties. The product is available to meet purchase of various assets as follows:

A) Motorcycle, Water

Tank, Posho Mill, Solar Panel, Water Pump and Generator among others:

The terms and conditions are:

B) Motor Vehicles

Terms and conditions are:

Loan term is:

C) Mortgage (Land and Property):

The terms and conditions are:

Back Office Services Activity (BOSA) enables a member to make deposits and access credit services. The Deposit Accounts in BOSA include the following:

DEPOSITS.

These are non-withdrawable savings but are refundable on exit. The minimum contribution is Kshs 2,000 per month or 10% of basic salary whichever is higher. All members who have not attained the above minimum monthly contribution are encouraged to do so.

EDUCATION LOAN SCHEME (ELS).

This is special savings for members who may wish to access educational loans. The same is considered in multiples of 3 times subject to ability to pay.

MICRO-SAVINGS.

This is a savings account for Small and Micro–Enterprises. Members can access credit 3 times the savings depending on the product. Micro-savings accounts are as follows:

Biashara Savings/Biashara plus Savings: These are savings accounts available to all members who operate businesses. Credit is considered in multiples of 3; subject to ability to pay and acceptable security. Loan approval is based on graduated levels.

MICRO - GROUPS JOINING CONDITIONS:

ASSET FINANCING SAVINGS.

This is a special savings account for SACCO members who are interested to acquire assets such as land, housing, and commercial motor vehicles. Credit is considered in multiples of 3.5 and 5.

BENEFITS OF DEPOSITS:

Front Office Services Activity (FOSA) offers basic banking services. The Jamii Savings Accounts in FOSA include the following:

This is a unit of ownership of the SACCO and members earn dividends on the same annually when declared. The Share Capital is not withdrawable but can be sold or transferred to an existing member upon one’s withdrawal from the SACCO. The minimum share capital is Kshs.20, 000.00 or 1000 shares of Kshs.20.00 each.

Reasons why a member should have a Share Capital account:

Members who have not attained this new minimum threshold should strive to do so at the earliest opportunity through the following means:

The following technology-based services are provided by the SACCO:-

M PESA Service.

This is a money transfer service from SACCO to members using mobile phones. The members can also make deposits and loan repayments through M-PESA Pay Bill Number 532200.

ATM Service

This is a facility that allows members to access funds from their FOSA savings accounts using Co-op Bank SACCO link card from Co-operative Bank ATM cash point or any other VISA branded ATM. The following applies:

Real Time Gross Settlement (RTGS)/ Electronic Funds transfer (EFT)

This is a service available in the SACCO for transfer of funds to members’ accounts in other banks.

Loan Clearance Facility

Members are reminded that the SACCO has a facility to clear outstanding loans except Biashara/Biashara loans and Asset Finance Loan. All loans are cleared by the SACCO including development loans, other SACCOs and bank loans as follows:

Sale of Bankers Cheques.

On behalf of Co-operative bank, the SACCO sells bankers cheques to members at a cost of Kshs 100 per leaf.

Mobile Banking Product.

The SACCO is in the process of introducing a mobile banking product where members will be able to access various services including limited credit facilities. This service will be rolled out in due course and all members will be notified accordingly.

This product finances full insurance premium for motor vehicle where members take comprehensive insurance cover with an identified insurance company namely: Co-operative Insurance Company (CIC), Madison Insurance or Direct line depending on the type of cover or any other approved insurance underwriter. The features are as follows:

GENERAL LOANING CONDITIONS.

•The member must be a check off based member from public service, parastatal or stable private organization.

•The loan is granted immediately a member joins the Sacco and makes the first installment.

•A maximum loan of up to is Ksh.300,000

•1/3 of the loan granted will be transferred to the deposits and Ksh.10,000 is immediately transferred to share capital.

•The loan must be fully guaranteed by either guarantors or collateral.

•Repayment period is 20 months.

•Interest rate is 1.04% per month or 12.5 % per annum on reducing balance.

•Ability is computed based on 1/3 rule of member’s salary.

•Must be recovered through the payroll.

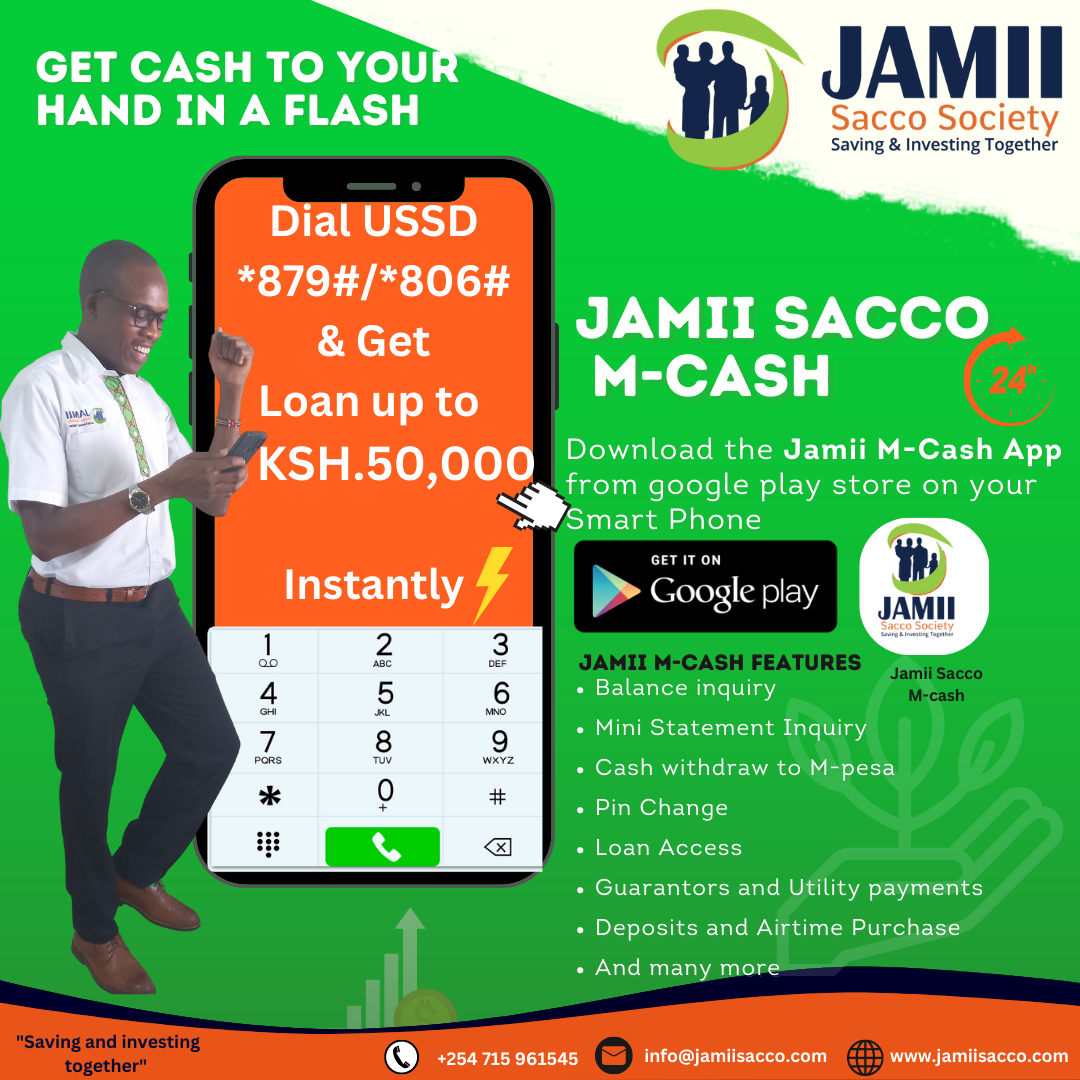

![]() Dial USSD *879# or *806#for Non –smart phone holders.

Dial USSD *879# or *806#for Non –smart phone holders.

![]() Download the Jamii M-Cash App on your Smartphone from playstore for Android phone holders.

Download the Jamii M-Cash App on your Smartphone from playstore for Android phone holders.

![]() Account balance Inquiry for all your accounts

Account balance Inquiry for all your accounts

![]() Mini statement Inquiry

Mini statement Inquiry

![]() Mobile Money/ Cash withdrawal

Mobile Money/ Cash withdrawal

![]() PIN Change

PIN Change

![]() Funds Transfer

Funds Transfer

![]() Mobile Loan Application

Mobile Loan Application

![]() Cash Deposit to all accounts

Cash Deposit to all accounts

![]() Utility Payments

Utility Payments

![]() And many more

And many more

The loan is applied and granted through mobile phone and the terms and conditions are as follows:

![]() Member must subscribe/register to the Sacco M-banking services (Fill Jamii M-Cash Form).

Member must subscribe/register to the Sacco M-banking services (Fill Jamii M-Cash Form).

![]() A member must attain the minimum share capital of Ksh. 10,000.

A member must attain the minimum share capital of Ksh. 10,000.

![]() Considers a member up to 80% of the member deposits but up to a maximum of Ksh. 50,00

Considers a member up to 80% of the member deposits but up to a maximum of Ksh. 50,00

![]() A member can qualify to borrow up to Ksh. 5,000 without graduation subject to attaining the above conditions.

A member can qualify to borrow up to Ksh. 5,000 without graduation subject to attaining the above conditions.

![]() A member eligible to borrow more than Ksh. 5,000 will be subjected to a graduation factor of 1.5 conducted once in 30 days.

A member eligible to borrow more than Ksh. 5,000 will be subjected to a graduation factor of 1.5 conducted once in 30 days.

![]() The interest rate per month will be 5.3% for I month, 6.3% for 2 months, 7.3% for 3 months, 8.3% for 4 Months and 9.3% for 5 months charged on the principal loan one off. The interest will be accrued and not recovered upfront.

The interest rate per month will be 5.3% for I month, 6.3% for 2 months, 7.3% for 3 months, 8.3% for 4 Months and 9.3% for 5 months charged on the principal loan one off. The interest will be accrued and not recovered upfront.

Repayment can either be done using either USSD (Dial *879#/*806#), Jamii M-cash App or Paybill number532200. Dial *879# or *806#, then choose in the menu the product type you want to access loan, or deposit and if using Paybill 532200 then keying the account number-ID NUMBER OR MEMBERSHIP NUMBER THEN THE PRODUCT CODE.

Some of the charges that apply for the above services are:

![]() Account Balance Inquiry – Kshs. 10.

Account Balance Inquiry – Kshs. 10.

![]() Mini Statement – Kshs. 10.

Mini Statement – Kshs. 10.

![]() Cash withdrawal – Kshs. 50 upto a maximum of Kshs. 70,000 per transaction.

Cash withdrawal – Kshs. 50 upto a maximum of Kshs. 70,000 per transaction.

NOTE:

![]() M/s Safaricom Limited Charges an average of Kshs. 5 in Airtime for every USSD Session.

M/s Safaricom Limited Charges an average of Kshs. 5 in Airtime for every USSD Session.

This account is designed to help you achieve your Holiday dreams.

Features

Requirements

It is advisable to open and start operating this account early enough so as to enjoy your sunset years. This account can be accessed immediately after retirement.

Features

Requirements

Main Features of the Account

Requirements

As the name suggests it is an account for our children and grand children

Features

Requirements

Page 6 of 7